Digital Dollars, Real Yield

Stablecoins are becoming an operational layer of global finance. $283B in circulation. $27.6T moved in 2024. Instant settlement, real yield, enterprise-grade use cases. Our flagship report “Digital Dollar, Real Yield” is our most practical, enterprise-focused stablecoin briefing yet.

Download our report now.

What’s in the report

The Programmable Money Revolution

Why Now: Three Macro-Forces Colliding

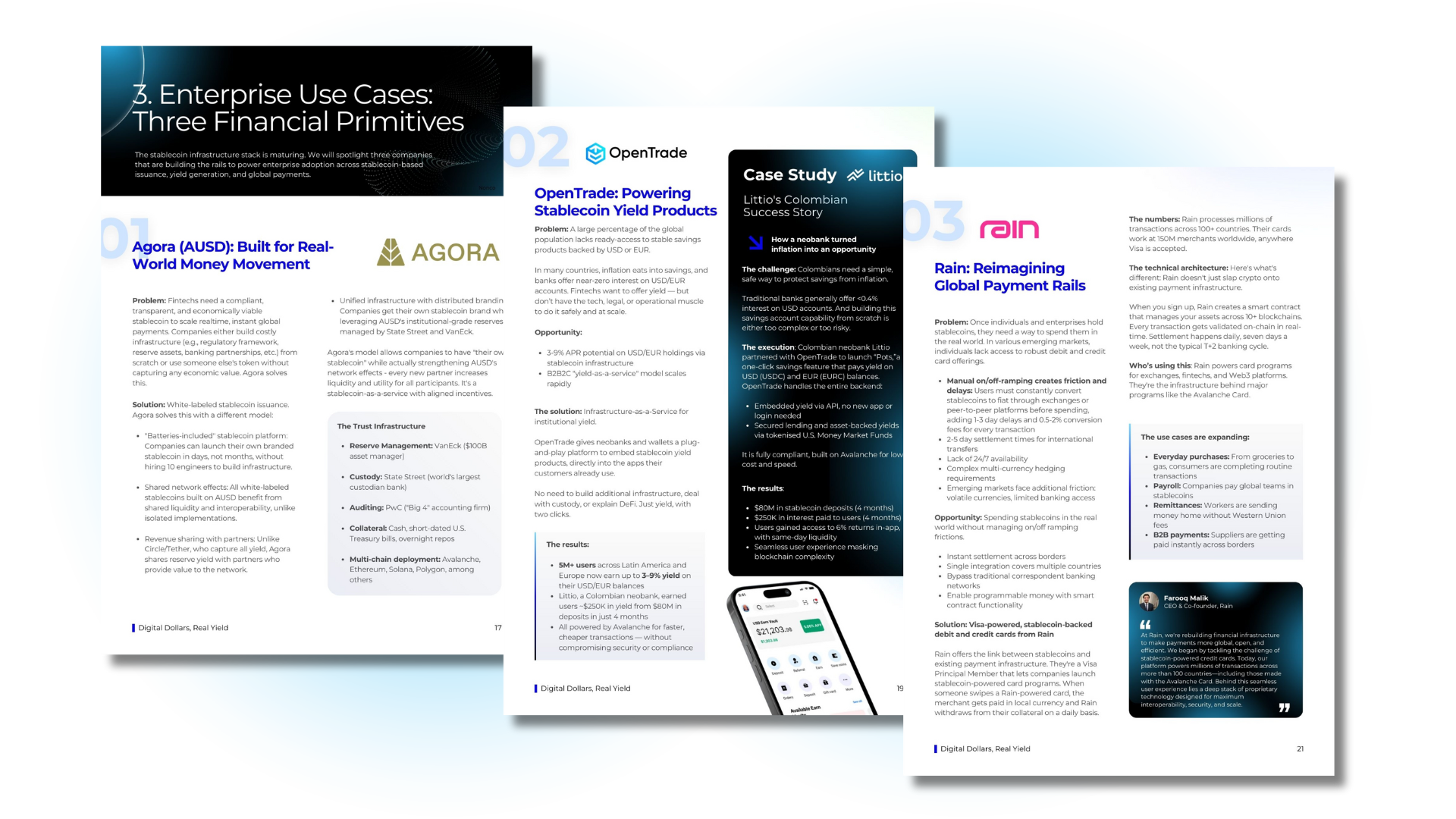

Enterprise Use Cases: The Three Financial Primitives

The Blockchain Tech Stack: Choosing Your Rails

The Stablecoin Ecosystem 2025 Map

What To Do Now: Strategic Playbooks for Business Leaders

What you’ll get:

The 3 primitives every enterprise needs: Issuance, Yield , Global Spend

Our complete Stablecoin Ecosystem 2025 map with the key players in issuance, infrastructure, and payments.

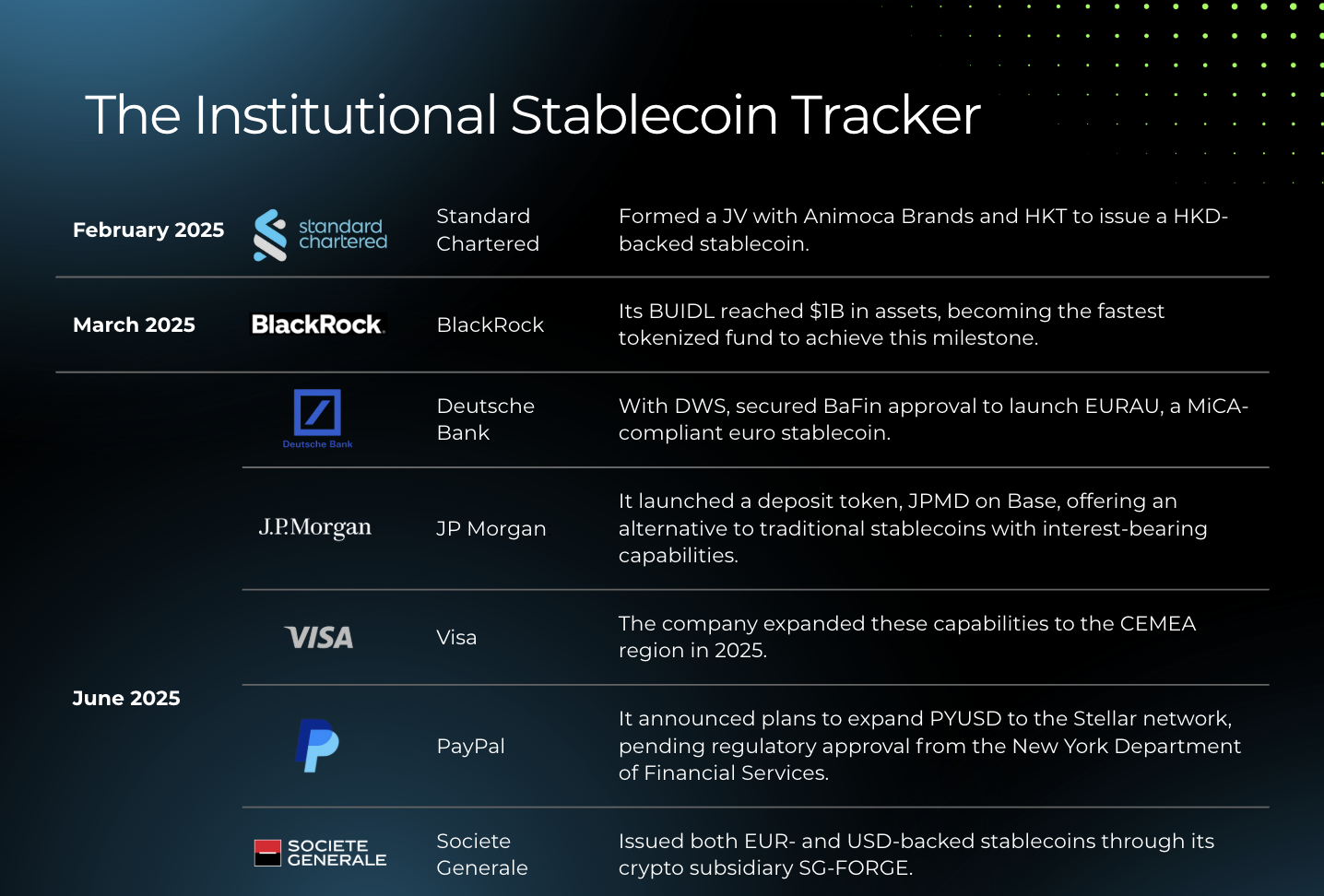

The Institutional Stablecoin Tracker, detailing the latest moves from BlackRock, JPMorgan, Citi, and Visa.

and much more.

Watch our live webinar from Aug 14th

Fortune 500 giants and modern Fintechs are rebuilding their financial infrastructure to optimize working capital, slash transaction costs, enable real-time global settlement and achieve new levels of operational efficiency and transparency.

But how can businesses capitalize on this opportunity?

Join leading operators & innovators:

David Sutter (CEO, OpenTrade)

Tony McLaughlin (CEO, Ubyx)

Marc Baumann (Founder & CEO, 51) (Moderator)

As they unpack how fintechs, corporates, and startups are leveraging stablecoin rails to unlock new yield, liquidity, and operational efficiency.