Money Movement 2.0

Money is moving — and this time, it’s real. Stablecoins are no longer a crypto experiment. They are now an active, growing infrastructure layer of the global financial system. This report is designed as both a strategic primer and an actionable guide for financial institutions, enterprises, fintech operators, and policy leaders.

Our Insight & Data Partners

Stablecoins’ Killer Use Cases

Opportunities and early adopters in international business payments, corporate treasury, international payroll, capital markets and commerce. We focus on Visa, PayPal, Mastercard, JP Morgan, and others.

We evaluated 100s of vendors across 4 enterprise-critical dimensions and 30+ metrics with our proprietary 51 Trust Score™.

Who are the most important players?

How Stablecoins are Disrupting Commerce

Stablecoins aren’t just a better way to move money. They are a core primitive for programmable internet-native money and agentic commerce. We tracked Stripe, Shopify, Coinbase, Google, Tether and others.

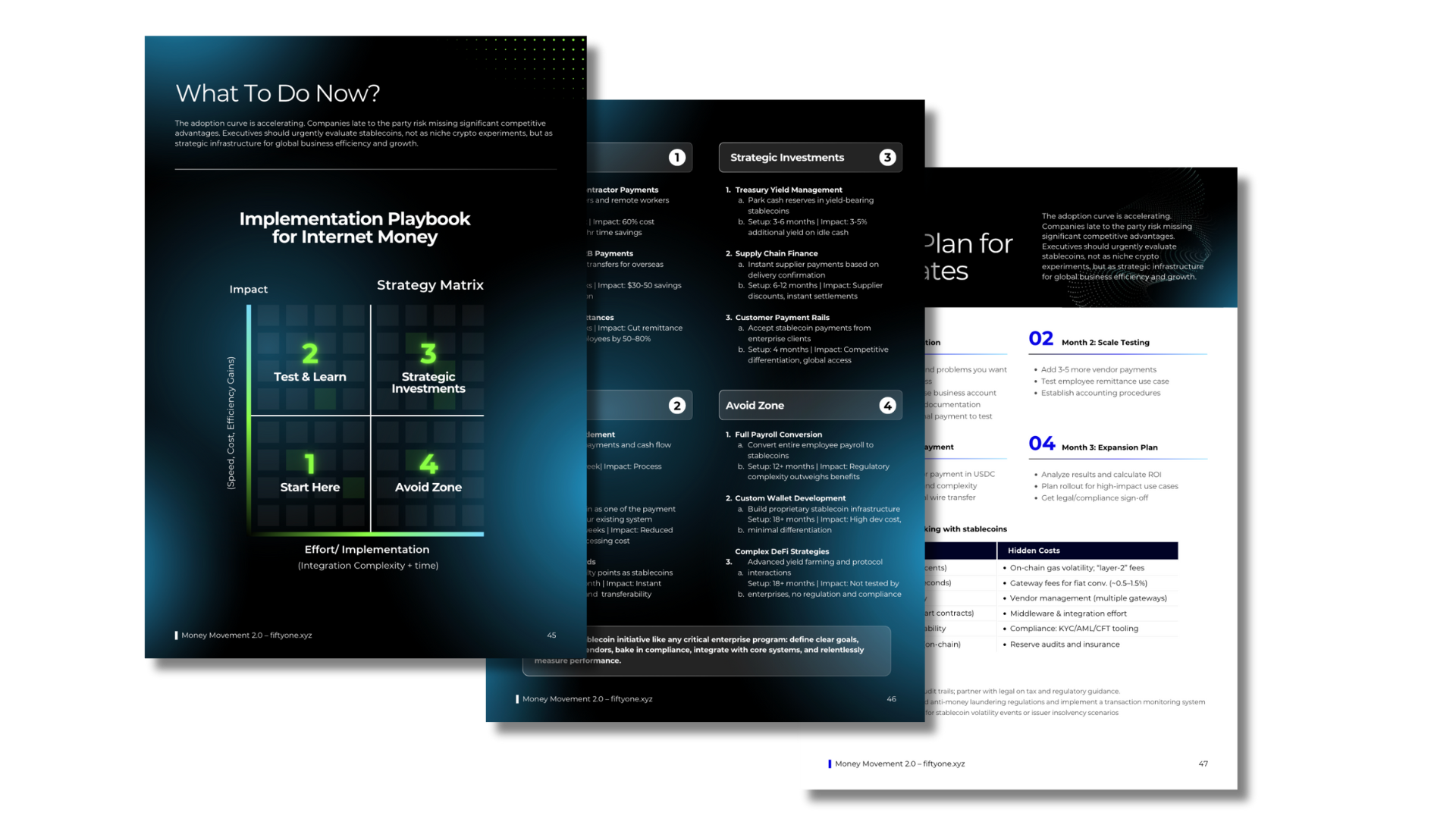

What to do now?

The adoption curve is accelerating. Companies late to the party risk missing significant competitive advantages. Executives should urgently evaluate stablecoins, not as niche crypto experiments, but as strategic infrastructure for global business efficiency and growth.

Join 30k+ digital asset leaders

We cut through noise, explain what others can’t, so you can focus on what matters.